Insights

Financial sustainability programs don’t work

4 reasons performance improvement programs fail – and what to do about it

Key Takeaways

- Significant cost challenges present a mountain for the public and private sectors to climb

- And yet financial sustainability programs (whether in the private, or public sector) have a limited chance of success

- The four biggest causes of failure in these programs are 1. A poor understanding of the cost levers to pull; 2. A poor cultural setting; 3. A lack of commercial nous and 4. A poor project execution capability

- A disciplined framework for performance improvement deals with each of these barriers to success

- Benchmarking your firm against this framework can highlight areas of potential improvement

A situation – on repeat

It is clear that major institutions, particularly those in the public sector, face an ongoing challenge to maintain financial sustainability.

The negative jaws of flat or low-growth revenue, combined with rapidly rising costs, and the ongoing rising demand for essential or critical services, come together to create a wicked problem.

We are seeing this play out in many if not all the jurisdictions we serve as an advisory firm – whether that be across all levels of Government, the Higher Education Sector, in Consumer businesses or even in the usually-profitable Financial Services sector.

In Local Government in particular we have seen rate caps hold income levels to 4-5% CAGR, while costs increase at a CAGR north of 6% before upward demand pressure is taken into account.

Over 20 years with SPP we have seen this story play out multiple times.

Efficiency (cost reduction) drives, as part of or even the main driver of “transformation programs”, are in full swing in many if not all of the client-organisations that we serve. Sponsored either by a GM Transformation or even the CEO, these programs identify a wide tranche of key projects to deliver to help create ongoing sustainable economics for the business.

So why do they so often fail to deliver on expectations?

The cost saving conundrum

Although they are created with well-meaning and intent, we have seen and directly experienced outcomes on many cost-down or efficiency drives that are sub optimal.

1. The public sector agency, held in the straight-jacket of change resistance, that cannot see a way to maintain service levels if costs are reduced;

2. The private infrastructure firm that does ongoing circle work due to the inability to get the Senior Executive to agree (negotiate) budget changes;

3. The Council(s) that despite ongoing protestation, cannot find a way to encourage their Councillors to stop over-promising without considering the capital and operating cost implications of their promises;

4. …and the organisations that stand up internal teams to deliver efficiency savings, only to discover that mountains of well-intentioned workshopping and analysis are having little-to-no impact

Despite all the best of intentions, these programs often deliver very little other than flatlining the cost base as new cost-increases such as EBA-based pay changes and baked-in-service provider fee increases come into play.

Why don’t these programs stick?

In most cases, when working with our clients we are typically being brought in after some effort has been made internally to drive change. The success of these programs has varied – but a consistent set of themes are typically present that hold the organisation back from achieving a more sustainable cost position. These are, in order of preferred treatment:

1. A poor understanding of the true cost drivers

“We don’t understand the problem”. It’s a common sentence uttered by CFO/COO/Dep Sec that we hear frequently when discussing cost-down efforts. And one thing that often prevents cut through is a hazy understanding of the over-arching economics of the business – the drivers of revenue, cost, and surplus. This challenge can range from a poor underlying budgeting process – all the way through to significant issues with cost-data and the business ERP.

But it often extends a little further to a “learned helplessness” whereby team members working in finance roles do not have the time or resource to resolve these issues, with a resulting circle-work mentality – never quite getting on top of the work to the degree that it frees them up to “sharpen the saw”.

This inability to understand costs, cost drivers, and potential levers of change is a significant problem – it can often lead to the organisation over-investing in areas that don’t deliver the assumed savings, or missing key drivers or levers that can have a much higher impact. This knowledge deficit also feeds into a lack of organisational commitment – if the problem is not clear and crisp, then it is usually harder to enlist the buy-in of the broader team to do something about it.

2. A poor cultural setting and attitude to cost reduction

“The toe cutters are back”. It is a short but powerful sentence that gets uttered in organisations when cost is on the agenda, and where to that point in time, savings targets have not been achieved. But why does such a negative description get attributed to an effort that, in effect, is actually critical to the ongoing health, if not survival of the organisation?

In many cases, the impact of cost-saving-measures are communicated in ways that are cumbersome, clumsy, or even downright aggravating. People hear about these measures too late in the process to enable them to feel ready to take on the change. Or, worse still, the savings measures are defined and executed in ways that are poorly thought through – with little buy-in and negative connotations.

In addition, we would also argue that cost-consciousness is not missing – many of those working in larger organisations seek to deliver an improved cost position on an ongoing basis – but unfortunately, being cost-conscious is seen as being “scrooge like” or not focused enough on growth or increasing the size of the pie. We believe this is an unfair way to look at cost- and that the whole “revenue is good, cost is bad” perspective needs to be addressed. Great organisations give equal credence to both sides of the equation, and encourage ongoing positive ideas on how to deal with both.

3. A lack of commercial nous and financial literacy

“We don’t understand the financial implications of our decisions – we are not data driven.” Some years back SPP published a small piece of qualitative research on the importance of commercial nous in business improvement programs. We discovered that the most common capability that was lacking in business-improvement teams (not just more generally in the organisation) was a lack of financial nous.

This means not just a lack of understanding of the P&L, although this would be a great start. It also means that many people working in the organisation don’t “get it” when different commercial constructs are being considered. Or even more simply, they can’t estimate the benefits of a cost-saving initiative, as they are (a) lacking in estimation skills, and (b) don’t have enough financial literacy to understand how different numbers in the business interact.

It’s critical to build this skill in your organisation if ongoing financial sustainability is a desired outcome.

4. A poor execution capability

“We are not making any real progress”. In many cases we have experienced as a firm, despite the key ingredients of clarity, buy-in and commercial nous, the organisation falls over at the last hurdle – which is the ability to “get stuff done”.

PMO’s bloom and gantt charts aplenty are prepared, but for some reason, the work does not translate to the desired efficiency gains or savings.

Most organisations find it challenging to staff an efficiency drive or transformation, whether that be due to budget constraints, available experience in the market, cultural fit, or all of the above. In addition, internal programs don’t always train at the level required to produce experienced business change and improvement Executives, quickly. This leaves the organisation with a resource base that, despite well meaning efforts, fails to achieve sustainable cost savings that stick.

But why can’t a well-meaning group of people achieve the desired outcome?

Challenges range from underestimating the effort, to working on the wrong things, to not having the right people in place, to taking too much on more generally (e.g. the transformation program with hundreds of initiatives). The wood gets lost for the trees very quickly, and things drift.

Why do these issues exist?

The underlying reasons for these barriers

- Changing appetite: The focus, commitment, and attitude toward efficiency tends to wax and wane depending on the economic circumstances at any particular point in time;

- Changing capacity: For similar reasons the organisation does not have an “always on” or ongoing approach to improvement – as a result, resourcing is achieved via a burst capacity when specific opportunities or demands arise, meaning that the capacity is rebuilt and then broken down on an ongoing basis;

- Unclear career path: The work in these program areas is not always seen as being as critical or as “senior” as a line role, thereby diminishing the attractiveness of working in this area;

- Association with negative messaging: Communication on issues associated with cost or efficiency can sometimes be seen as negative – hence there is a negative bias, at some level, related to being involved in these programs (although this does seem to be changing

Proven pathways to success

The key ingredients

Driven by these insights, we have formulated, trialled, embedded, and succeeded with a method for the ongoing successful execution of efficiency programs. On a repeated basis we have seen a formula for success which is delivered by client organisations. The critical ingredients comprise:

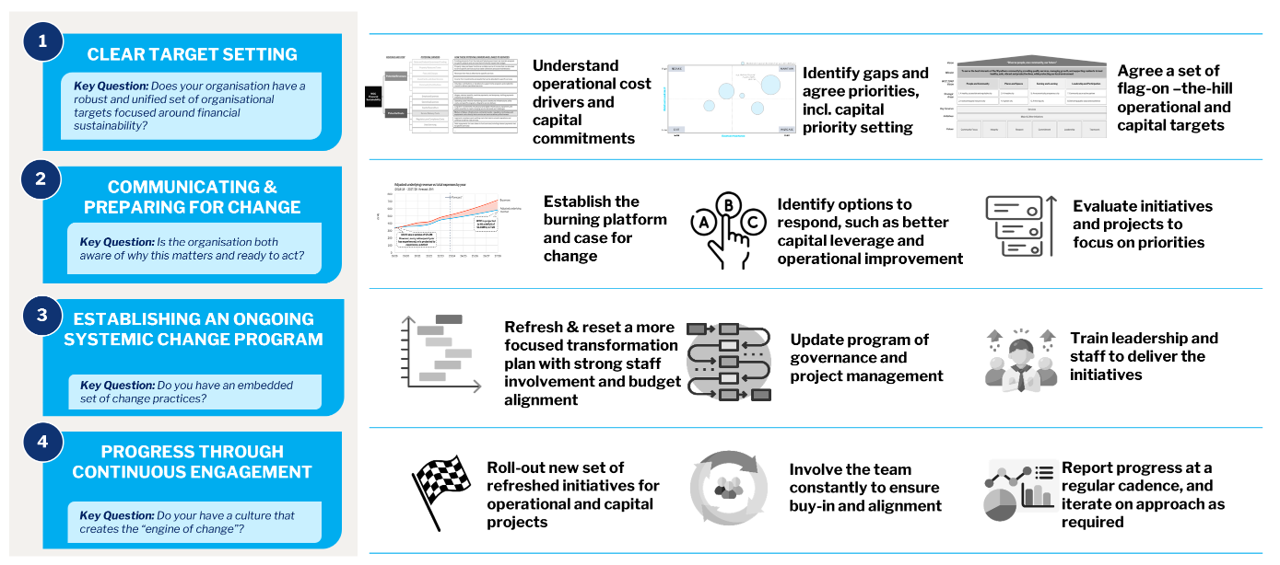

| 1. Clear Targets | A set of very clear targets, with a strong understanding of operational cost drivers, a change in resource mix and priorities, and a flag-on-the-hill end state |

| 2. Change Preparation | Financially sustainable firms constantly prepare for change – they instill a sense of forward movement in the team, and identify a clear and achievable set of initiatives to pursue. All members of the firm are aware of the challenge, the proposed approach, and their role |

| 3. Program Establishment | A program is established with strong staff involvement and clear budget parameters, with governance in place and with a leadership and management team with the capability to deliver the proposed initiatives. |

| 4. Ongoing Continuous Improvement Program | A continuous process of refresh and ongoing waves of improvement are implemented, recognised, rewarded, and reported against. |

The SPP model for implementation of a successful improvement capability

The diagram below brings to life the specific skills and capabilities needed by organisations to achieve financial sustainability.

Some things to think about

- Does your organisation have an ongoing financial sustainability program in place?

- Where are the gaps in understanding cost and efficiency drivers?

- How clear is current communication?

- Do you have a systemic approach in place including a co-ordinated business improvement effort led by trained and capable team members?

- Where are you at in rolling out a set of targeted initiatives?

About SPP

SPP are experts in the delivery of the plan, establishment, and roll-out of client-led improvement efforts. Our method is based on over 20 years of experience in a range of industry sectors and has delivered millions in both hard-savings as well as efficiency gains to the organisations we serve. We have been successful in empowering internal teams to take forward their improvement capability.

Please feel free to reach out to the contacts below if you are interested in talking about the challenges your organisation is facing in achieving financial sustainability.

Key Contacts

Clara Yates / Principal

Clara Yates is a Principal at SPP and works closely with organisations to tackle their major strategic challenges. Clara brings particular expertise in the Education sector having worked with Universities, VET providers, Online Education Providers, Research Institutes and education...

Connect on email

Connect on LinkedIn

Phil Noble / Founder and Managing Partner

Phil Noble is the Founder and Managing Partner of SPP. He is an experienced General Manager, Consultant and Entrepreneur and has worked in a wide range of industries including financial services, telecommunications, infrastructure and Not for Profit. Phil has...

Connect on email

Connect on LinkedIn