Insights

Optimising the Service Model for Mutual Banks: Balancing Service, Scale, and Digital Transformation

Reimagining service excellence for Mutual Banks

Mutual Banks have traditionally delivered service through branches, personal relationships, and tailored products for specific communities or industries. But the market is shifting: rising costs, digital expectations, and regulatory demands are putting pressure on mutuals’ existing operating models, while larger banks offer broader services and seamless digital experiences, widening the gap.

It is critical for leaders of Mutual Banks to ask – How can we preserve our service edge while adapting to a more complex, digital-first environment?

Mutual Banks operate within a challenging operating environment given their subscale nature

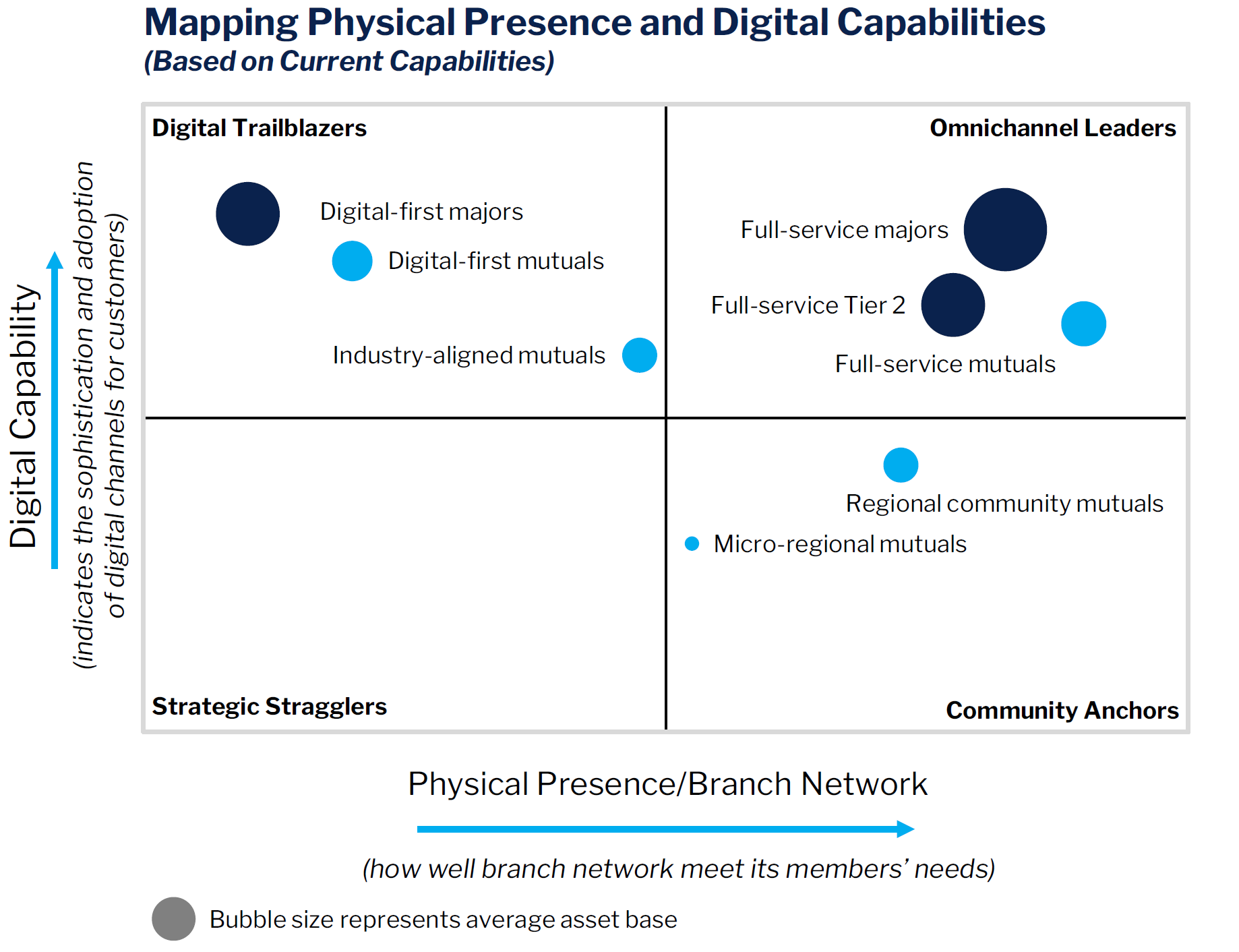

Mutual Banks face structural limitations that constrain their ability to deliver traditional service models. Their subscale nature means they often lack the capital and reach to match the omnichannel delivery of larger players. SPP’s analysis shows mutuals span a spectrum – from community anchors with strong local presence but lagging digital capability, to digital trailblazers with lean footprints and robust tech.

This diversity reflects the trade-offs mutuals must make between physical and digital service. The service model a mutual can afford and the experience it can deliver is shaped by its archetype and scale.

Mutuals cannot give up high service standards as this is a key and persistent differentiator

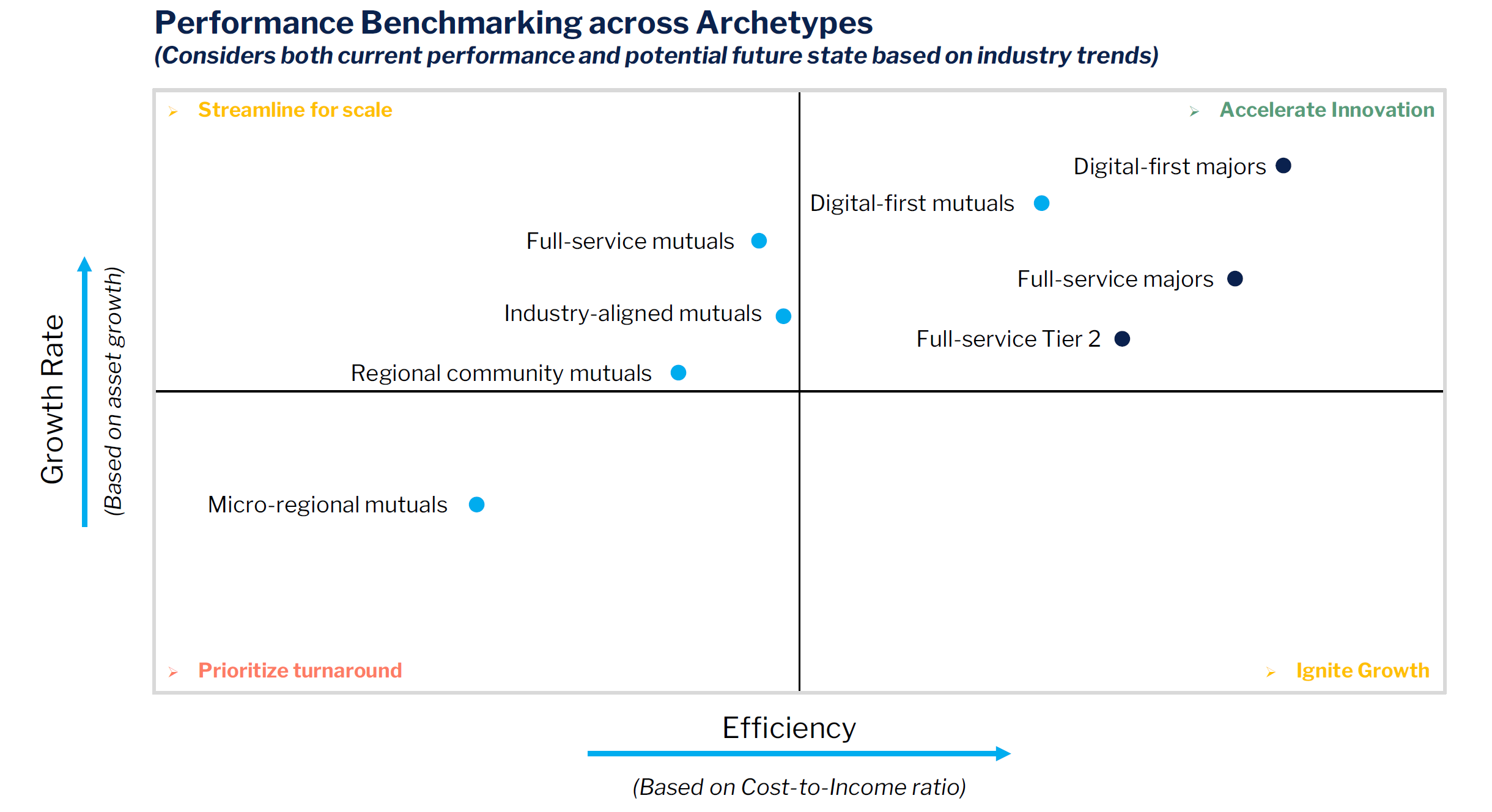

Benchmarking performance across the different archetypes reveals that Mutual Banks generally underperform larger players on both growth and efficiency, facing higher cost-to-income ratios and modest revenue growth when compared to larger banks.

Despite these challenges, mutuals consistently outperform larger banks in customer satisfaction. Their Member-first ethos and personalised service are core to their identity. But sustaining this advantage is becoming harder as digital expectations rise and investment capacity remains limited.

Mutuals can future-proof service by blending digital ease with human support, tailored to Member needs.

Leading mutuals are already demonstrating effective approaches:

- Designing channel mixes around Member needs

- Making digital service effortless and complete

- Using human channels for high-value moments

- Integrating channels for a seamless experience

- Continuously improving through Member feedback

Winning in this highly competitive space requires careful consideration of the bank’s operating model and scale and combining this with a deliberate, Member-centric channel strategy.

A hybrid of digital and human channels, with tailored interventions, delivers the most effective customer service model for mutuals

There is no universal blueprint for service delivery. The optimal mix of digital, in-person and assisted channels varies by archetype.

- Full-service mutuals benefit from strong branch networks with assisted digital activities.

- Industry-aligned mutuals require expert-led human channels tailored to professional contexts.

- Regional players must balance community engagement with digital support.

- Micro-regionals must focus on niche specialisation and basic digital capabilities.

- Digital-first mutuals should lead with mobile and online, reserving human support for complex needs.

Customisation is critical – the right model depends on who you serve and how you operate.

Why is this challenge so persistent for Mutual Banks?

Although mutuals understand the need to evolve, many struggle to move from intention to execution. While subscale size and higher cost-to-income ratios limit investment capacity, the more persistent barriers are internal. Complex organizational structures, legacy enterprise agreements, and ongoing uncertainty about future direction or potential mergers often slow decision-making and make it difficult to commit to a single path forward.

Bridging the gap between knowing what’s needed and making real progress requires more than just awareness. It demands a clear, actionable roadmap that can guide mutuals through uncertainty and help them turn intent into tangible outcomes.

SPP has extensive experience optimising service delivery for Mutual Banks

SPP supports Mutual Banks through a structured service model transformation approach. Our Strategic Evaluation Framework combines diagnostic tools with transformation mapping to align service delivery with Member needs and digital maturity.

In a recent engagement, SPP helped an industry-aligned Mutual Bank identify over 15% annual cost saving opportunities while improving service delivery. This bank leveraged expert-led human support tailored to its Member base, complemented by digital tools that enabled mobile and remote access. The resulting service model balanced trust, accessibility and relevance.

SPP’s approach is grounded in four key themes:

- Strategic evaluation of service model archetypes

- Alignment of channels with Member expectations and complexity

- Optimisation of physical formats and digital augmentation

- Delivery of measurable outcomes in cost and experience

We bring deep sector experience and a track record of delivering tailored, high-impact solutions.

Design tomorrow’s service model today

The market is shifting fast, and Members are becoming increasingly more discerning, digitally savvy and value-driven in their banking choices. Mutuals must act now to redefine their service model before subscale becomes strategic stagnation!

You don’t have to do it alone – SPP can help define your archetype, diagnose your gaps and build your bespoke mix. Reach out for further insights/data!

Key Contacts

Daniel Lemcke / Partner

Daniel brings over 15 years of industry and consulting financial services expertise to SPP. With international experience across banking, treasury, transactions and trading domains, Daniel is focused on delivering practical outcomes.

Daniel is trusted by executives of leading Financial...

Connect on email

Connect on LinkedIn